On October 27, 2016, Cohen paid Daniels’ attorney, Davidson, $130,000.

Weiselberg’s handwritten notes about the repayments to Cohen are attached to bank statements in the company’s files, McKenney said.

Those memos described a $180,000 base reimbursement plan for Cohen — including a fee for Davidson and an unrelated tech bill. Weiselberg estimated that that total would be doubled, or “grossed up,” to cover state, city and federal taxes, which Cohen paid.

According to the memos, Weiselberg added a $60,000 bonus, for a total of $420,000. The money is to be paid in 12 monthly installments of $35,000 each.

McConnie’s own notes were also shown to the court. After calculating that Cohen would receive $35,000 a month for 12 months, McConney wrote: “Monthly wire from DJT.”

Asked what that meant, McConey said, “It’s not in the president’s personal bank account.”

McConney said he doesn’t know of any other time when an employee has paid a refund to cover the company’s tax expense. Reimbursements to employees, if classified as such, are not taxable.

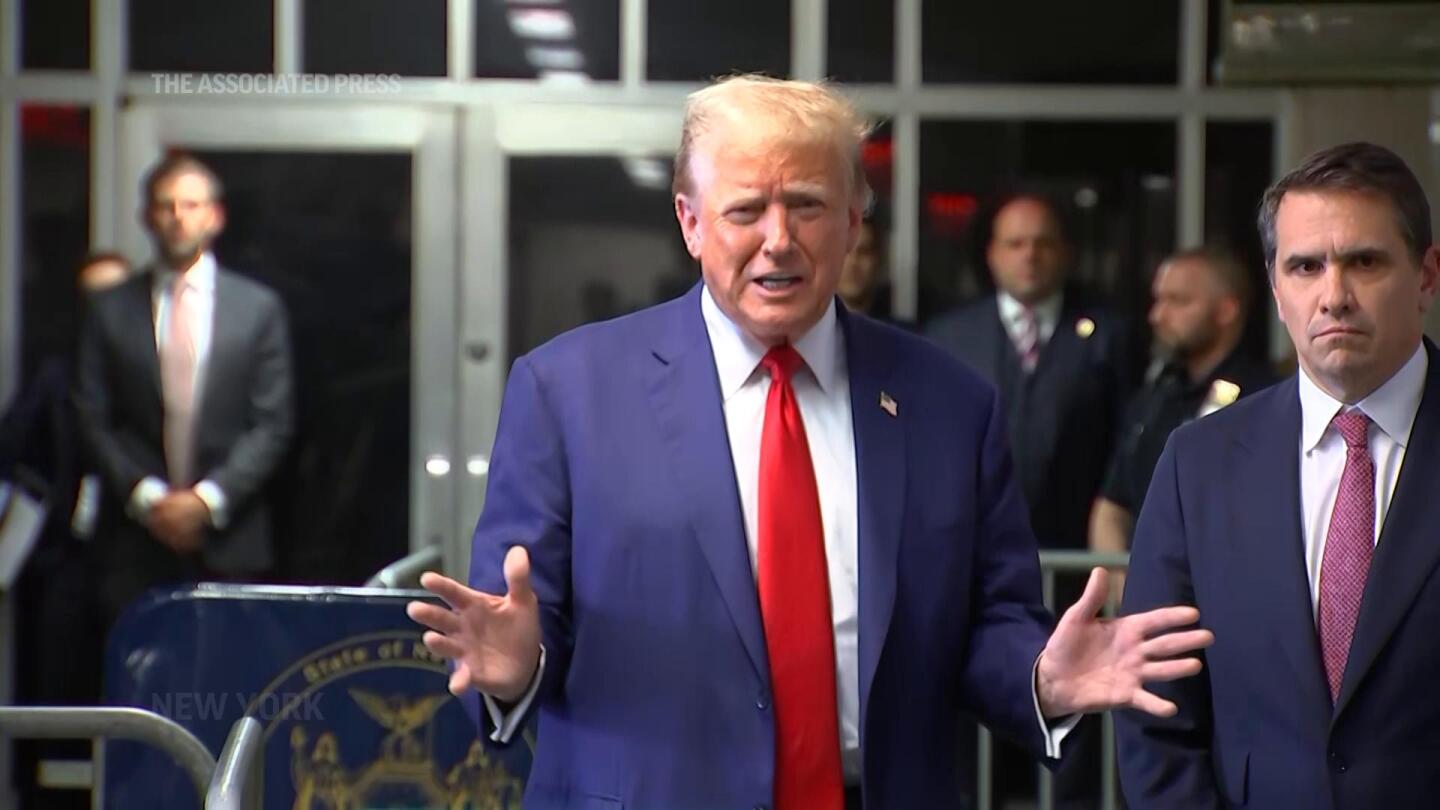

Trump has been accused of falsifying business records by misrepresenting the money paid to Cohen in his company’s records as legal fees. Prosecutors argue that by paying him income and paying additional taxes, Trump administrations were able to hide the repayments.