Turkey’s lira The Turkish lira has weakened to its weakest level in nearly a year as traders worry about the continuation of President Recep Tayyip Erdogan’s “unsustainable” economic policies after his election victory this weekend.

The lira fell 1.2 percent to a fresh record of 20.36 against the U.S. dollar as trading resumed in London, the main hub of European currency trading, after a public holiday on Tuesday. The currency, which has lost a fifth of its value in the past year, hasn’t closed a day by such a wide margin since June 2022, FactSet data show.

With Turkey’s currency reserves rapidly depleting and other indicators flashing warning signs, many economists argue that Erdogan’s low interest rates and emergency measures to prop up the lira cannot continue.

“The current policy stance has become unsustainable,” said Liam Beach at Capital Economics in London. “Turkey cannot burn through very low interest rates, very loose fiscal policy and all kinds of foreign currency reserves for long.”

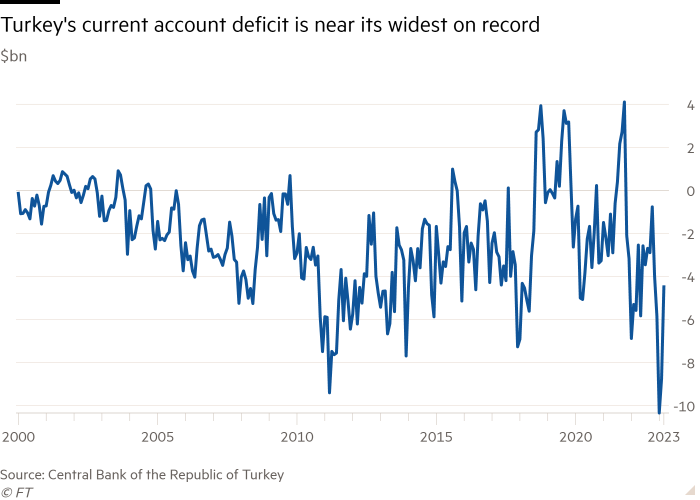

Turkey’s reserves have fallen by around $27bn this year as the country tries to prop up the lira and finance a current account deficit that is near record levels.

Official data put foreign currency and reserves, including gold, at over $101bn.

However, according to JP Morgan, net reserves, a figure that strips out loans, have zero effect and are deeply negative, excluding tens of billions of dollars in cash borrowed from the local banking system.

“Reserves are now close to levels when the lira’s volatility increased sharply earlier,” said Clemens Graf, an economist at Goldman Sachs in London.

But immediately after his victory in Sunday’s run-off vote with 52 percent of the vote, Erdogan insisted he would maintain his low interest rate policy, even though inflation is now above 40 percent.

“If anybody can do it, I can do it,” he said. “[The central bank’s main interest rate] Now reduced to 8.5 per cent, you will see inflation coming down as well.

“Eliminating the problems of inflationary inflation and loss of welfare are the most pressing topics in the coming days,” he added.

Erdogan used a wide range of state resources before the election, including giving consumers a month of free gas. The government is undertaking a major reconstruction effort following February’s devastating earthquake that killed more than 50,000 people and destroyed thousands of buildings. Economists said consolidated spending could trigger a new burst of inflation.

“Sustainably reducing inflation and the current account deficit will require tighter monetary and fiscal conditions. Any change in monetary and fiscal policies will be significant for the economy and markets,” said Fatih Akcelik, Turkey economist at JP Morgan.

Investors are also worried about the equivalent of $121bn Turks have in special savings accounts to pay for government spending if the lira falls.

The move has reduced the rate at which Turks buy foreign currencies, but Finance Minister Nuredin Nebati said the accounts would cost the country about TL95.3bn ($4.7bn) from their introduction in 2021.

If the lira falls sharply in the coming weeks, the impact on public finances will increase rapidly.

Analysts, however, believe that Erdogan will be able to secure new funding from allies in the Middle East and Russia.

The president said last week that unnamed Gulf states had provided financing to help stabilize Turkey’s markets, but he did not elaborate.

Erdogan will probably get a short-term boost from summer tourism receipts, which will ease pressures on the country’s finances, said Wolf Piccoli at Teneo consultancy.

Turkey’s Bist 100 stock index, boosted by locals seeking refuge from high inflation, rose more than 4 percent on Monday and another 2.8 percent on Tuesday.

Some economists said Erdogan could appoint a new economic team and bring back familiar names to foreign investors.

“With the elections behind us, all eyes will be on the composition of the Economic Council and the credibility of the initial policy response,” said Ilkar Tomak at Citigroup.

But Domac warned that keeping Turkey’s central bank interest rates well below inflation would be “more challenging”, “especially in the last quarter of the year and beyond”.

Other economists signaled a greater degree of caution.

“Be prepared for the worst, such as formal capital controls or serious deposit flight from the banking system,” says Istanbul-based Global Source Partners consultancy.